DMITRY KALINICHENKO

Western accusations against Putin traditionally lie in the fact that he served in the KGB. And so, it was an austere man, immoral, and so on. Putin blamed for everything. However, no one has ever accused Putin, a lack of intelligence.

Any charges against this man, only emphasize its ability to fast analytical thinking, the ability to instantly take clear and adjusted political and economic decisions.

Often, the Western media, Putin’s ability to compare this with the ability to GM, conducting public simul at blitz chess. Recent developments in the US economy and the West in general, lead to the conclusion that in this part of the assessment of Putin, the Western media are absolutely right.

Despite numerous triumphant style Fox News and CNN, to date, the economy of the West led by the US, was trapped Putin. The possibility of release from which the West can not see and can not find one. And the more the West is trying to escape from this trap, so his position becomes hopeless.

What is something truly tragic situation of the West and the United States, where they were? And why all the Western media and the leading Western economists, silent on this point, as the most important military secret? Let’s try to understand the essence of the economic events right now, from the point of view of the economy, leaving as much as possible for the discussion of all the nuances of morality, morality and geopolitics.

So, after realizing his failure in Ukraine, the West led by the US, has set a goal to destroy the Russian economy by reducing the price of oil and gas, respectively – both the core budget-Russian sources of export revenues and the primary source of Russian gold reserves. It should be noted that the main failure of the West to the Ukraine, is not in the military and in political terms. And in the actual failure Putin to finance this project western Ukraine, at the expense of the Russian budget. What makes this project West priori viable in the near and inevitable future.

The last time under Reagan, like the West’s actions to reduce oil prices, led to success and the collapse of the USSR. But history does not repeat itself. At this time, for the West, everything is different. What the West said Putin seems both to chess and judo. Where the forces spent adversary to attack used against him, but with minimal cost of its own forces and resources defending. Putin’s real policy publicly. Therefore, the real Putin’s policy, more is always directed not only impressive, but on efficiency.

Very few people understand what it is that makes Putin at the moment. And almost no one knows what he will do in the future.

As much as it may seem strange, but right now, Putin sells Russian oil and gas, only for physical gold.

Putin does not shout about it to the whole world in the style of hype. And he certainly still accept US dollars, as an interim means of payment. But he was right there, all these changes from the sale of oil and gas US dollars for physical gold!

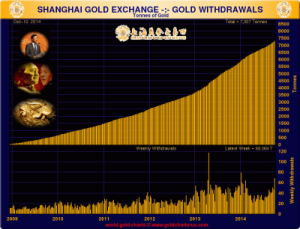

To understand this, just look at the dynamics of growth of gold in the structure of the gold reserves of Russia and to compare these data with the Russian currency earnings coming from oil and gas sales for the same period.

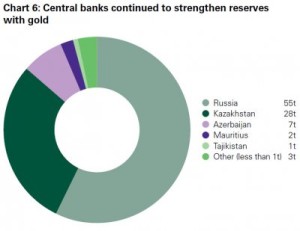

Moreover, in the third quarter, buying physical gold Russia, were at an all-time high, record levels. In the third quarter of this year, Russia has been purchased an incredible amount of gold in the amount of 55 tons. This is more than bought according to official figures, central banks all over the world together!

In total, central banks around the world, purchased in the third quarter of 2014, 93 tons of the precious metal. It was the 15th consecutive quarter, net purchases of gold by central banks. Of the 93 tonnes of gold purchases by central banks around the world during this period, great volumes of purchases of 55 tons, fall on Russia.

Not so long ago, British scientists successfully came to the same conclusion, which a few years ago, was published in Opinion USGS. Namely: Europe can not survive without energy supplies from Russia. Which is translated from English into any other language in the world is: “The world can not survive if the balance of the global energy supply, subtract oil and gas supplies from Russia.”

Thus, all built on the petrodollar hegemony of the Western world, was in a catastrophic situation. In which, to survive without oil and gas supplies from Russia, the West can not, and its oil and gas Russia, is now ready to sell to the West in exchange for physical gold! The piquancy of the situation in this Putin’s party of the situation is that the mechanism of the sale of the West Russian energy only for gold, now works regardless of whether the West agrees to pay for Russian gas and oil.

Because Russia, having at its disposal regular income dollars from the sale of oil and gas, in any case, be able to buy them for gold. At current gold prices, depressed by hook or by crook, by the same West.

That is, at the prices of gold, which were artificially and carefully understated the Fed and the ESF at times, against the artificially inflated through market manipulation, the purchasing power of the US dollar. Interesting fact: The suppression of the special department of the Government of the United States – ESF (Exchange Stabilization Fund) gold prices, in order to stabilize the exchange rate of the US dollar, built in the United States to the rank of Law.

In the financial world, accepted as axiomatic postulate that gold is antidollars.

– In 1971, US President Richard Nixon closed the “gold window”, ending the free exchange dollars for gold, guaranteed by the United States earlier in 1944 in Bretton Woods.

– In 2014, Russian President Vladimir Putin, has opened a “gold window”, not paying attention to what they think and talk about it in Washington.

Right now, the West spends a lot of its efforts and resources on it to suppress the price of gold and oil. Thereby, on the one hand to distort the existing economic reality in favor of the US dollar. On the other hand – to destroy the Russian economy, refusing to play the role of obedient vassal of the West.

Right now, assets such as gold and oil, look proportionally weakened and extremely undervalued against the US dollar. What is the consequence of the enormous economic effort on the part of the West.

And right now, Putin sells Russian energy resources in exchange for these artificially fortified efforts of the West to US dollars. For that, he immediately buys gold – artificially humiliation against the US dollar, the efforts of the West!

Another interesting point in Putin’s party – a Russian uranium. Through the supply of which in the US is now working every sixth light. And that Russia sells US dollars for the same.

Thus, in exchange for Russian oil, gas and uranium, the West pays Russia US dollars, purchasing power, artificially inflated against oil and gold, through the efforts of the West. But Putin, uses the US dollar only to withdraw them in exchange for the West, its physical gold – at artificially low by the same West gold prices denominated in US dollars.

This is truly a brilliant combination of economic Putin puts the West led by the United States in the position of the snake, aggressively and zealously devouring its own tail.

The idea of this economic gold trap for the West, most likely originally belonged not to Putin. Most likely, it was the idea of Putin’s adviser on economic issues – Academician Glazyev. Otherwise, why would seem not involved in the business Glazyev government official, along with many Russian businessmen, including Washington was personally in the sanction lists of the West? Idea economist Academician Glazyev, Putin brilliantly realized, with prior full support from his colleagues from China – Xi Jinping.

Of particular interest in this context looks November statement first deputy chairman of the Central Bank of the Russian Federation Ksenia Yudaeva. Which stressed that the CBR may use gold from its reserves to pay for imports – if need be. Obviously, in terms of sanctions by the Western world, this statement is addressed to the BRICS and especially China. For China, Russia’s willingness to pay for goods western gold is very handy. Here’s why: as mentioned in a previous materials,

China recently announced that stops to increase their gold reserves denominated in US dollars. Taking into account the growing trade deficit between the US and China (the current five-fold difference in favor of China), this statement is translated from the financial language is: “China stops selling their goods in dollars.” The world’s media, it is the grandest in the recent monetary history of the event, chose not to notice. And the question is not whether China is literally refuses to sell their goods for US dollars. China, of course will continue to accept US dollars as an interim means of payment for their goods. But taking dollars, China will immediately get rid of them and replace the dollar in the structure of its gold reserves to something else. Otherwise makes no sense, the statement made by the monetary authorities of the PRC, “We stop to increase their gold reserves denominated in US dollars.” That is, China will not buy more of the proceeds from the trade with any country dollars Treasuries – government US Treasury bonds, as they have been doing it all the time before.

Therefore, China will replace all the dollars that he would receive for their products not only from the US but also in general from all over the world on something else – “not to increase their gold reserves denominated in US dollars.” And here, there is a very interesting question: what is China will replace all of its resulting from trade dollars? On what kind of currency or asset? Analysis of the current monetary policy of China shows that the most likely coming from trade dollars or a significant part, China will quietly replace and de facto substitute for gold.

In this aspect, Solitaire Russian-Chinese relations, develops extremely well for both Moscow and Beijing. Russia buys goods directly from China for gold at its current price. And China buys gold at its current price, the Russian energy resources. On this Russian-Chinese celebration of life, there is a place around: and Chinese goods, and Russian energy, and gold as a settlement. Out of this celebration of life space, only one wish – the US dollar. This is not surprising. Because the US dollar is neither Chinese goods, nor Russian energy. He is only an interim financial instrument settlement – unnecessary middlemen. And unnecessary intermediaries, from the scheme of interaction between the two independent business partners, decided to exclude.

It should be noted separately that the global market for physical gold is negligible in relation to the physical world market oil supplies. And even more so, the global market for physical gold microscopic, in relation to the totality of the physical world markets of oil, gas, uranium and goods.

The emphasis on the phrase “physical gold” is made because, in exchange for their physical, rather than paper, energy, now Russia withdraws from the West gold only in the form of his physical, rather than paper delivery. Same as China does, withdrawing from the West to the current artificially low prices at times, it is a real physical gold – as a means of payment for physical delivery to the West, its real goods.

Western hopes that Russia and China will accept as payment for their energy and all sorts of goods, or the so-called shitkoin “Paper gold”, is also not justified. Russia and China, as a final means of payment, are only interested in gold and just as the physical metal.

For reference: the turnover in the market of paper gold only in the form of gold futures is estimated at about 360 billion. US dollars per month. But only US $ 280 million a month, take physical delivery of gold. That forms on paper gold trading against physical gold, the ratio of 1000: 1.

Applying the mechanism of active withdrawal from the market of the West artificially low financial asset (gold), in exchange for another West artificially high financial asset (US dollars), Putin is hereby incorporated countdown for world hegemony of the petrodollar. Thus, Putin has put the West in a deadlock absence of any positive economic prospects. West can spend as many of their forces and equipment, on the artificial increase in purchasing power of the dollar, lower oil prices and the artificial lowering of the purchasing power of gold. West only problem is that the stocks of physical gold at the disposal of the West, are not limitless. Therefore, the more the West devalues oil and gold against the US dollar, the more rapidly it loses ceap Gold, from their far endless reserves. In this brilliantly played out Putin’s economic combination of physical gold reserves of the West, is rapidly flowing away in Russia, China, Brazil, Kazakhstan and India – in the BRICS countries. At such a speed reduction of physical gold reserves as of now, the West is simply no time to do anything against Putin’s Russia, until the collapse of the entire Western world design petrodollars. In chess, a situation in which Putin has put the West led by the US, called “time trouble.”

The Western world has never faced such economic events and phenomena that are happening right now. SSSR, in the fall of oil prices, rapidly sold gold. Russia, in the fall of oil prices, rapidly buys gold. Thus, Russia poses a real threat to the existence of the American model of petrodollars, world domination.

The main principle of the model petrodollar world, allowing Western countries led by the United States to live at the expense of labor and resources of other countries and peoples, based on the dominant MIF (world monetary system), the role of the national currency of the USA. The role of the US dollar in AIM is that it is the ultimate means of payment. This means that the national currency of the United States in the structure of MAM is the ultimate asset accumulation, change that to any other asset that does not make sense. What is now doing the BRICS countries, led by Russia and China, actually changes the role and status of the US dollar in the global monetary system. From the final means of payment and asset accumulation, the national currency of the United States, the joint actions of Moscow and Beijing, becomes only an intermediate means of payment. Intended only to exchange an intermediate means of payment, on the other, and indeed the final financial assets – gold. Thus, the US dollar is deprived of its role as the final means of payment and asset accumulation, giving both the role of other universally recognized, depoliticize monetary assets – gold.

Traditionally, the West used two ways to eliminate the threats petrodollar hegemony model of the world and thereunder exorbitant privilege for the West.

One of these methods – the color revolutions. The second method, which is usually applied the West, if not work the first way – this military aggression and bombing.

But in the case of Russia, both of these methods are for the West is either impossible or unacceptable.

Because, firstly, the population of Russia, unlike the people in many other countries, has consistently failed to exchange their freedom and their children’s future, west sausage, which you can get right now. This becomes evident at a record high rating of Putin, regularly published by the leading rating agencies of the West. Personal friendship protege Washington Navalny, with Senator McCain, played for him and Washington very negative role. Upon learning of this fact from the media, 98% of Russia’s population, now perceive Navalny, solely as a vassal of Washington and the traitor of national interests of Russia. Therefore, about any color revolution in Russia, Western professionals, thinking reality until even dream is not necessary.

As for the second, the traditional method for the West – direct military aggression, Russia – this is not Yugoslavia, not Iraq and Libya. When any non-nuclear military operations against Russia, on the territory of Russia itself, the West led by the US, is doomed to a crushing defeat. And the generals in the Pentagon, exercising real leadership by NATO forces are well aware of this. Similarly, no prospects and a nuclear war against Russia, including the concept of the so-called “Preemptive preemptive nuclear strike.” NATO simply not technically possible to put such a blow that would completely disarm the nuclear potential of Russia, in all its many guises. The response, massive nuclear retaliation against the enemy or pool opponents will be in this case is inevitable. And its total capacity will be sufficient to ensure that the survivors envy the dead. That is to say, a nuclear exchange with a country like Russia, is in principle not to address emerging problems of collapse petrodollar world. This is at best finale and the last point in the history of its existence. In the worst case, it’s a nuclear winter and cease to exist on the planet of life, except for the mutated by radiation bacteria.

In the western economic establishment, see and understand the essence of the phenomena.

The leading Western economists certainly aware of the depth of tragedy and hopelessness of the situation, which turned out to be the western world, hitting the economic golden trap Putin. Indeed, since the time of the Bretton Woods agreements, everyone knows the golden rule: “Who has more gold, he sets the rules.” But more about that in the West, everyone is silent. Silent because no one knows how this situation now find a way out.

And because if you explain all the details of the Western public the ongoing economic disaster, this public ask worst for supporters of petrodollar world issues.

Which will be:

– How long will the West be able to buy oil and gas from Russia in exchange for physical gold?

– And what will happen to the petrodollar United States, after the West over physical gold to pay for Russian oil, gas and uranium, as well as to pay for Chinese goods? “.

The answer to these seemingly simple questions, in the West today, nobody can.

And this is called Checkmate, gentlemen. Game over.

Poo materials online media prepared

Tatiana Dobrodeeva.

Central News Agency Novorossia

Novorus.info

http://novorus.info/news/analytics/30466-zapadnyy-kapkan-grossmeystera-putina.html

Translated by APIR Center

March 5, 2015

March 5, 2015

Опубликовано в

Опубликовано в